Want to know how Masala Bonds work? Discover their advantages, issuance process, and how they compare to foreign currency bonds for global investors.

Masala Bonds are used by Indian entities like the government or corporations to raise debt from investors in foreign countries. The term ‘Masala’ was given by the International Finance Corporation (IFC) to give an essence of the Indian culture.

This blog provides insights into what are masala bonds, their features, advantages, disadvantages, and all the other details.

What are Masala Bonds?

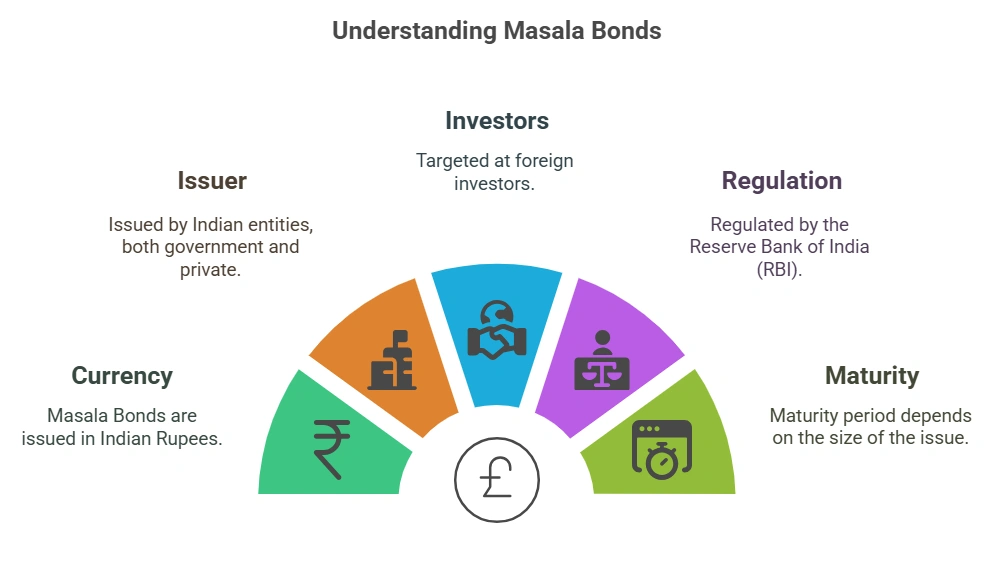

Masala bonds are a type of bond that is issued by India-based entities to foreign investors. These bonds are issued to foreign investors in Indian Rupee (INR), which transfers the risk of currency fluctuations to foreign investors rather than Indian entities.

These bonds fall under regulations set by the Reserve Bank of India (RBI). The main difference between masala bonds vs foreign currency bonds is that the masala bonds let issuers borrow money in Indian Rupees, protecting them from the currency rate changes. Unlike foreign currency bonds, where the exchange rate risk burden falls on the issuers.

Features of Masala Bonds

Features of Masala Bonds

Let us explore some of the features of masala bonds:

- Issuer: Both the government and private entities are allowed to issue masala bonds.

- Issued in INR: These bonds are issued in Indian rupees, unlike other foreign bonds that are denominated in foreign currency.

- Overseas Issuance: These bonds are purchased by foreign investors, and they are listed on exchanges like the London Stock Exchange (LSE).

- Regulation: The RBI oversees the masala bonds regulatory framework.

- Interest Rates: The interest rates for these bonds are decided by the entity issuing these bonds. They generally try to provide investors with competitive interest rates.

- Maturity: If the proceeds of the issue are lower than $50 million, then maturity tenure is three years. For issuance greater than $50 million, the bonds will have a five-year maturity.

Benefits of Masala Bonds

Here are the masala bonds benefits:

- Access to Global Funds: With the help of masala bonds, Indian businesses can get access to foreign funds, which attracts foreign investment. It also helps businesses in diversifying their sources of funds.

- Low Currency Risk for Issuer: Foreign investors who wish to invest in Masala bonds bear all the risk of currency fluctuation, and issuing entities are safe from it.

- Issuer Credibility: When a company witnesses fund inflows (in the form of debts) from foreign investors, its credibility among other investors increases. This opens pathways for further investment in Indian companies.

- Strengthens INR: Masala bonds are basically issued in Indian rupees, and that boosts the demand for Indian currency abroad, which is great for the Indian economy.

Disadvantages of Masala Bonds

Now let us understand some disadvantages of the masala bonds:

- Market Liquidity: The market for masala bonds can face liquidity issues, and this can discourage investors from investing in masala bonds.

- Higher Interest Rates: To compensate the foreign investors for the additional risk they are bearing, the issuers of masala bonds have to pay them higher interest rates. This puts a financial burden on issuers.

- Issuance Challenges: The masala bonds issuance process and regulatory framework can be complex and lengthy.

- Indian Economy: Any downturn or slowdown in the economy can make masala bonds less attractive to foreign investors.

- Currency Risk for Investors: A significant drawback is the potential for losses due to exchange rate fluctuations, as the depreciation of the INR can negatively impact foreign investors.

Types of Masala Bonds

Just like other corporate bonds, masala bonds can also be categorized on their interest payment method and maturity:

Based on Maturity

- Short-term Bonds: These bonds have a maturity period of three years and can be suitable for those investors looking to have short-term exposure to Indian securities.

- Long-term Bonds: They have a maturity greater than three years and can be suitable for investors looking for long-term exposure to Indian financial assets.

Based on Interest Payment

- Fixed-Rate Bonds: The fixed interest rate stays the same for the bond until it matures.

- Flexible-Rate Bonds: These are usually pegged to a benchmark and move in accordance with the benchmark.

How are Proceeds from Masala Bonds Used?

There are some limitations set by the government that prohibit the use of money raised from masala bonds for certain activities, these include:

- Activities prohibited by FDI guidelines

- Investing the proceeds from masala bonds issue into capital markets is not allowed

- Purchasing land

- Lending the funds to other entities.

The funds raised from the masala bonds can be used for:

- Refinancing current loans

- Providing working capital for the companies

- Funding the development of affordable housing programs.

Masala Bonds vs Other Currency Bonds

| Bond Type | Currency of Issuance | Location of Issuer | Issuing Market (Buyer of Bonds) | Currency Risk |

| Masala Bonds | Indian Rupee | India | International | Investors |

| Yankee Bonds | US Dollar | Foreign | United States | Issuer |

| Maple Bonds | Canadian Dollar | Foreign | Canada | Issuer |

| Samurai Bonds | Japanese Yen | Foreign | Japan | Issuer |

| Kangaroo Bonds | Australian Dollar | Foreign | Australia | Issuer |

Conclusion

The masala bonds are used by Indian corporations to raise debt from foreign investors. This allows foreign investors to channel funds in India and, at the same time, fulfills the funding needs of Indian entities without bearing currency risk.

Understanding how Masala Bonds operate and how they compare to other international bonds is essential for both issuers and investors aiming to diversify their portfolios and contribute to economic development.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.