When saving your money you are bound to be cautious and well-researched. Striking a balance between optimal risk and desired returns is essential. Typically, assets that carry high risk deliver higher potential returns.

On the other hand, financial instruments that carry lower risk generate relatively lower yet steady returns. You need to determine your short and long-term goals to take advantage of different asset classes in your investment portfolio.

Fixed income instruments are suitable for stable and constant returns. Diversifying a portfolio with a mix of assets, including secure options like fixed-income, is a common approach. Fixed deposits are safe avenues of investment that yield fixed returns over a period.

In this blog, we are set to uncover how fixed deposits fare against debt funds, a similar investment option. We will decode Debt Mutual Funds vs Fixed Deposits by exploring their key features, benefits, and main differences.

What are debt funds?

Debt funds are a form of pooled portfolio of investments that primarily invest in fixed income instruments such as government bonds, corporate bonds, etc. Their returns are generated by the interest earned on these securities. Debt funds are affected by market conditions, therefore, their returns are volatile.

Since debt funds invest in various securities, their portfolio is diversified. These funds are managed by Asset Management Companies (AMCs), where experienced fund managers take the ultimate investment decision, keeping in mind the goals of the fund.

Benefits of investing in debt funds include:

- Liquidity: Debt funds do not have a lock-in period, which makes them liquid due to their quick redemption methods.

- Less risky than other equity mutual funds: Debt funds are comparatively secure than other mutual funds, including equity funds, as they invest in safer securities.

- Partial withdrawals: Debt funds give the advantage of partial withdrawals instead of making a full redemption. Thus, in case you need access to a small portion of your investment, you can redeem investments partially.

- Flexibility: Debt funds offer flexible investment options, such as long or short-term durations and credit risk options.

- Stability: Debt funds offer stability as they invest in stable, secure assets.

- Professional expertise: With proficient fund managers handling the portfolios, you are in safe hands when investing in debt funds.

Moving on to fixed deposits.

What are fixed deposits?

Fixed deposits are an investment option offered by banks and financial institutions, where you can earn a fixed rate of return on your deposits for a fixed period. They are available for different durations.

Due to being insured by the government, fixed deposits are often considered much safer investment options. Therefore, they do not carry any inherent risk.

How do fixed deposits work? You invest money for a fixed tenure at an interest rate. The banks then loan out your money to other borrowers and charge them a higher rate. This way, your money brings you a portion of this higher interest rate.

Fixed deposits bear benefits like:

- Guaranteed returns: The primary advantage of investing in fixed deposits is the safe and guaranteed returns attached to it. The interest rates are determined before investing.

- Easy to invest: Fixed deposits are simple investments that can be opened with minimal documentation. Banks offer a straightforward investment process, wherein you can go and get your fixed deposit started immediately.

- Higher interest rates: Fixed deposits yield higher interest rates than other saving options such as

- Tax benefits: Although the returns generated by fixed deposits are taxable, certain tax benefits can be claimed. Specifically, under tax-saving fixed deposits that allow tax deductions up to ₹1.5 lakhs under Section 80C.

- Less effort required: Investing in a fixed deposit scheme is usually a one-time effort. In cases where you do not have time to keep track of how your investments are performing over time, FDs work best.

Now that we know the key features and advantages of both debt funds and fixed deposits, let us check out the major differences between these.

Differences between Debt Funds and Fixed Deposits

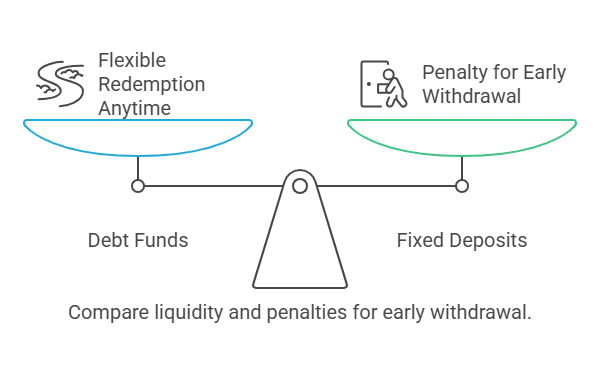

If you compare the liquidity in debt funds vs fixed deposits, debt funds are much more liquid. FDs usually come with a predetermined tenure and are challenging to be withdrawn before maturity. Early withdrawals may be allowed but with an imposition of a penalty charge. Whereas debt funds can be redeemed anytime, subject to an exit load.

The risk comparison between Debt mutual funds and Fixed deposits shows that the former has a higher risk due to its dependence on market factors. There is no risk involved in fixed deposits as they are safe assets backed by the government.

Debt mutual fund returns compared to fixed deposits are generally higher, consistent with the higher risk involved.

Previously, the tax benefits of Debt Mutual Funds over Fixed Deposits included their deferred tax treatment along with indexation benefits. However, the amendment to Finance Bill 2023 brought a change, removing the indexation benefits. Upon redemption, capital gains on debt mutual funds will now be charged at the investor’s income tax slab rates, as is the case with fixed deposits.

It is essential to consider the key differences when deciding between these investment forms.

As an investor, which one should you pick?

Debt Mutual Funds vs Fixed Deposits: Which one to choose?

The developments made in the Union Budget 2025 removed the tax benefits of debt mutual funds over fixed deposits. This makes it hard for investor to base their investment decisions on taxation benefits.

If you are looking to make higher returns, debt mutual funds can be considered more suitable. Moreover, if liquidity matters, sticking to debt mutual funds is more convenient for you.

However, if capital safety is your concern, choosing fixed deposits over debt mutual funds is a better option. Additionally, assured returns are often preferred over higher returns.

Final thoughts

Your financial goals and risk tolerance level take the front seat when determining a suitable option between debt funds or fixed deposits. It is always advisable to understand the differences between the two and then pick the right one aligned with your financial preferences.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.