RBI-approved forex broker in India is effectively offered only through SEBI-regulated brokers such as Zerodha, Upstox, Angel One, ICICI Direct, HDFC Securities, Kotak Securities, and Sharekhan, which provide access to INR-based currency pairs.

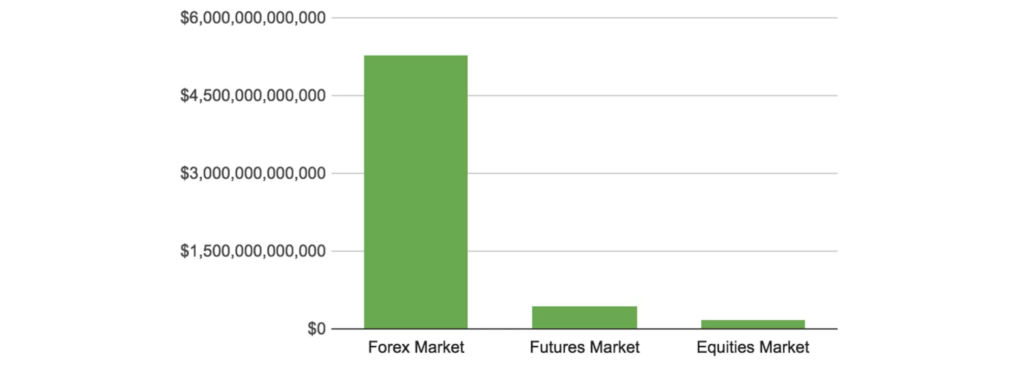

The Forex market is particularly convenient for Indian investors, as online trading and mobile apps are the primary ways to access it. The global foreign exchange market remains the largest, with daily transactions worth hundreds of trillions of dollars. In India, the domestic foreign-exchange market was valued at about US $30.7 billion in 2024, and is projected to reach around US $65.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of about 8.8 % from 2025-2033.

According to the RBI, Indian residents are allowed to trade foreign exchange only through authorised dealers and electronic platforms that are specifically allowed under the Foreign Exchange Management Act (1999).

What does “RBI-approved forex broker in India” actually mean?

1. Regulation & Scope of Forex Trading in India

- Under FEMA and RBI guidelines, Indian residents can transact in foreign exchange only via authorised persons (such as banks) or specified platforms.

- The domestic forex market in India is fairly modest in size, about US $30.7 billion in 2024.

- In India, typical restrictions apply: For retail individuals, the trading of foreign exchange is subject to the rules of recognised exchanges (like the National Stock Exchange of India or the Bombay Stock Exchange) for INR‐based pairs only. Some offshore brokers offer USD/EUR, etc, but that may violate Indian regulations.

- Many websites list RBI-regulated forex brokers for Indian clients; however, there is no broad licence issued by RBI to forex brokers for retail leveraged FX trading in the same way as, e.g., stock brokers. Many of those brokers operate offshore and are not approved in India.

2. What “approval” would imply

If a broker were genuinely an RBI-approved forex broker in India, then:

- The broker (or its Indian entity) would be registered with the RBI (or a designated Indian body) as an authorised dealer or permitted electronic trading platform under FEMA.

- It would comply with Indian regulations, permit only allowed currency pairs (typically INR + another currency), and use Indian banking/settlement channels.

- It would explicitly state regulatory status in India (e.g., Indian licence number) and be visible in RBI or SEBI listings or publicly verifiable lists of authorised persons.

3. The gap in practice

- Many brokers marketing to Indian investors claim “RBI approved” but are actually based offshore, operating under foreign licences or none, and accept Indian clients despite regulatory risk.

- The RBI maintains an Alert List of unauthorised forex platforms; using such platforms exposes investors to loss of legal recourse and, higher risk of fund non-recovery.

- For Indian retail investors, a safer route is via Indian regulated brokers (governed by the Securities and Exchange Board of India – SEBI) or via recognised Indian exchanges.

List of RBI-Approved (SEBI-Regulated) Forex Brokers in India

Investors who are in quest of an RBI-approved forex broker in India should keep in mind that the Reserve Bank of India (RBI) does not give the brokers a direct license for retail forex trading. However, brokers registered under SEBI and working on exchanges such as NSE, BSE and MCX-SX provide the trading of INR-based currency pairs. Below is a list of the reputed Indian brokers operating under SEBI and compliant with RBI’s FEMA guidelines.

| Broker Name | Regulatory Body | Key Features |

| Zerodha | SEBI Registered | Access to USD/INR, EUR/INR, GBP/INR pairs; simple platform for beginners. |

| Upstox (RKSV Securities) | SEBI Registered | Offers low brokerage fees and INR-based forex trading. |

| Angel One | SEBI Registered | Trusted full-service broker with research and advisory tools. |

| HDFC Securities | RBI & SEBI Supervised | Bank-backed broker with safe fund settlements. |

| ICICI Direct | RBI & SEBI Supervised | Provides forex trading via recognised Indian exchanges. |

| 5Paisa Capital Ltd. | SEBI Registered | Discount broker supporting INR-based currency derivatives. |

What to check: Criteria for a safe broker for Indian beginners

When evaluating a broker that claims “RBI-approved forex broker in India”, make sure to check:

- Verify whether the broker is registered in India / holds Indian regulatory credentials (RBI/SEBI) and is listed in authorised persons or alert lists.

- Ensure that trades are done in INR-based currency pairs only (e.g., USD/INR, EUR/INR), as domestic regulation generally prohibits retail trading of non-INR pairs via domestic authorised channels.

- Brokers should route funds via Indian banks/clearing channels, have clear KYC/AML compliance, and allow legal withdrawal of funds in India.

- Transparency: The broker must state which licence it holds (Indian or foreign) and must not promise very high leverage, exotic pairs, or “get rich quick” schemes targeted at Indian clients.

- Consider statistical evidence: Globally, about 99.6% of retail forex traders are unable to achieve more than four profitable quarters in a row.

- Also, Indian retail derivatives (not exactly forex but comparable risk domain) saw net losses of ₹1.06 trillion in FY 2025, up 41 % year-on-year—highlighting risk for retail participants.

Conclusion

RBI-approved forex broker in India may sound reliable, but in reality, India’s forex trading rules are quite strict. Only brokers registered in India and operating under FEMA, RBI, or SEBI regulations are legally recognised. Using unregistered offshore platforms can leave investors without legal protection.

Using brokers regulated by India and trading in currency pairs based only on INR is the safest option for beginners. Forex trading is risky and should not be considered an easy way to earn money.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.