With India heading into the end of 2025 on an improved growth trajectory, investors are returning to fixed-income instruments. The numbers show that in 2023–24, household financial savings (net) increased from 4.9% of GNDI to 5.1%. As the stock market and the world remain volatile with uncertainties making the headlines, the traditional Fixed Deposits (FDs) have again proved their value as a stabiliser and a consistent return.

The Bank of Baroda Fixed Deposit is one of the most reputable bank schemes in India, catering to investors who seek predictable growth and are wary of investments with unpredictable outcomes. Having a robust PSU base, favourable interest rates, and digital management as a bonus, the FDs of BoB have become a favourite among new and experienced investors.

About Bank of Baroda: A Trusted Name in Indian Banking

The Bank of Baroda (BoB) is one of the largest and most reliable Indian banks operating in the public sector, having been founded in 1908. Since it has an international footprint in over 15 countries and a client base of more than 130 million customers, BoB has established a reputation for reliability, innovation, and good governance.

The BoB World app and other strong digital ecosystems have made it easy for the bank to manage deposits. The Government of India supports BoB; the bank has a high credit rating and a sound balance sheet. For risk-averse investors, this means one thing: the safety of capital with stable returns.

Having more than one hundred years of goodwill, BoB still provides fixed deposit options that provide flexibility, high yield levels, and trust, which makes it one of the most favourable FD product providers in India.

Bank of Baroda FD Interest Rates (as of November 2025)

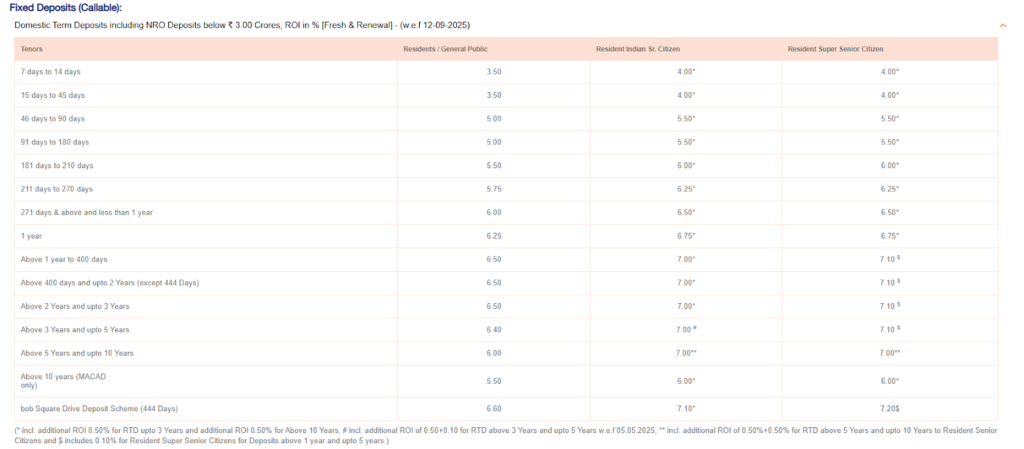

As of November 2025, Bank of Baroda Fixed Deposit interest rates range between 3.50% and 7.20% for the general public, depending on the tenure. A percentage boost is already in place for seniors, and those who are 80+ above receive an even bigger increase.

BoB also offers special FD schemes such as:

- Baroda Tiranga Plus Deposit – A limited-period offer for tenures between 399 and 999 days, offering up to 7.40% (regular) and 7.90% (senior citizens)

- Baroda Advantage (Non-Callable FD) – Higher returns for investors who don’t require premature withdrawal flexibility

Types of Bank of Baroda Fixed Deposits

1. Regular Fixed Deposit

This is the standard FD product of BoB with a flexible tenure of 7 days up to 10 years. It is perfect for those investors who want returns that are guaranteed with a compounding advantage.

2. Tax Saving Fixed Deposit

This scheme has a 5-year lock-in and has the benefits of Section 80C deductions of ₹1.5 lakh, making it an ideal choice among the salary income earners who would like to save on tax and also gain constant returns.

3. Baroda Advantage (Non-Callable FD)

This option is offered to investors who have the ability to tie up their funds until maturity and enjoy higher interest rates as compared to regular FDs. Premature withdrawal is however, not allowed.

4. Baroda Tiranga Plus Deposit

As a special scheme, this FD has increased interest rates on mid-range tenures. It is appropriate for investors who want short-term returns and do not want market exposure.

5. Recurring Deposit

Small monthly savers will find that BoB RD lets you invest a fixed amount each month and build a lump sum over time, ideal for discipline-loving savers and goal-oriented planning.

How Compounding and Tenure Work

BoB provides a range of tenure options, from one day up to ten years. The effective yield is increased by compounding the interest quarterly. For example, a ₹1 lakh investment for 1 year at 7.10% (quarterly compounding) will earn approx. ₹7,310, giving a maturity value of ₹1,07,310.

Important note: The frequency of compounding and the type of scheme determine the actual returns, which may differ slightly.

How Safe is Your Investment with BoB?

The most convincing force behind the popularity of Bank of Baroda Fixed Deposit is safety. As a Government-sponsored bank in the public sector, BoB is highly creditworthy and stable.

Furthermore, the Deposit Insurance and Credit Guarantee Corporation (DICGC) safeguards all deposits, up to ₹5 lakh per depositor per bank.

The good financial performance, capital adequacy ratio, and stable profitability of BoB make it much safer than smaller types of private banks or NBFCs that might have higher returns but a greater level of risk.

How to Open a Bank of Baroda Fixed Deposit

Online (BoB World app / Internet Banking):

- Log in to your BoB World app or Net Banking account.

- Go to the ‘Deposits’ section and select ‘Open Fixed Deposit.’

- Choose the amount, the term, and how you’d want to commence interest.

- Review details and confirm.

Offline (Branch Visit):

- Visit the nearest BoB branch with KYC documents.

- Complete the FD application and submit the required deposit.

- Collect your FD receipt or digital confirmation.

Key Details:

- Minimum deposit: ₹1,000

- Maximum: No upper limit

- Joint accounts, nomination, and auto-renewal options are available.

Why Choose Bank of Baroda FDs in 2025

- Strong PSU backing ensures trust and safety

- Attractive rates up to 6.60% for regular and 7.20% for super senior citizens

- Diverse schemes catering to tax planning, short-term, and long-term goals

- Convenient online access via the BoB World app and internet banking

- Auto-renewal and loan facility against FDs for liquidity

- Ideal for conservative and long-term investors seeking assured returns

Conclusion

With 2026 approaching, investors are becoming more interested in finding instruments that offer safety, liquidity, and stable returns. The Bank of Baroda Fixed Deposit perfectly fits in this classification. BoB offers one of the most reliable fixed-income products in India today, backed by strong PSU support, consistent rates, and the convenience of digital support.

BoB FDs give you the basis of financial stability, a safe haven in a fast-paced market, whether you are a senior citizen wanting a monthly paycheck or a young professional setting up a savings fund.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.