Stockbroking is emerging as one of the most promising career opportunities with increasing stock market growth and investor participation across India. Stock brokers act as intermediaries who connect investors with the securities market and execute trades on their behalf.

According to sources, the registered investors in India had a count of 100 million in August 2024, and at the same time, the demat accounts had increased from 40 million in 2020 to 14 million in 2024. To become a stock broker an individual needs to fulfill certain educational requirements, then get registered with the Securities and Exchange Board of India (SEBI), and finally, acquire practical knowledge through trading and handling customer relations.

What is a Stock Broker in India?

A stockbroker in India is a mediator who has obtained the respective license and is recognized by the market. They are responsible for executing purchase/sale transactions for the clients. Indian stockbrokers should abide by the regulations of the Securities and Exchange Board of India (SEBI) as well as the rules from the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE).

Requirements & Documentation to Become a Stock Broker in India

Becoming a stockbroker requires meeting the infrastructure and documentation standards set by SEBI and exchanges like NSE and BSE.

Eligibility Criteria

The eligibility criteria to become a stockbroker in India are mentioned below:

- Age: The individual must have attained 21 years at older.

- Education: The minimum education is 10+2, yet a Bachelor’s degree in either Commerce, Finance, Business Administration, or Economics is advisable.

- Certifications: It is required to pass the NISM Series VIII – Equity Derivatives and NISM Series I – Currency Derivatives tests. A score of 60% or more is required to be considered.

- Experience: Working with a registered stockbroker or an authorized person provides practical experience that contributes to developing important trading and compliance skills.

- Character: The candidate is required to have a good character with no involvement in criminal or financial misconduct.

Infrastructure & Net Worth Requirements

The infrastructure and net worth requirements are mentioned below:

- Office Setup: An office that is registered and has the necessary facilities, such as computer terminals for trading, reliable internet connectivity that is reliable, and space for customer service.

- Systems: A complete back-office, risk management, and compliance framework.

- Financial Strength: The net worth or security deposit that is stipulated for the chosen segment (equity, F&O, or currency) by the stock exchange has to be maintained.

Documents Required

The documents required to become a stockbroker in India are mentioned below:

- PAN card, Aadhaar card, educational certificates, and proof of NISM qualification.

- Proofs of corporate office address and infrastructure (lease or utility bills).

- Net worth certificate, audited financial statements, and bank details

- KYC of promoters or directors and company incorporation documents (if applicable).

Step-by-Step Guide to build career as a Stock Broker in India

The step-by-step guide to becoming a stockbroker in India is mentioned below:

- Acquire the Right Education:

Finish 10+2 and then take a degree in finance or commerce to enhance knowledge of trading and investments. - NISM Certification:

Clear the mandatory NISM exams recognized by SEBI to become eligible to work as a broker or sub-broker. - Get Hands-On Training:

Be an employee of a broker or authorized person and receive real-time training in order execution, settlements, and client handling. - Pick Your Position:

Depending on resources and goals, choose to be an Authorised Person, Sub-broker, or Trading Member. - Register with SEBI & Exchange:

Send the application along with all the documents required to SEBI and the favorite stock exchange (like NSE or BSE). - Establish and Develop Your Business:

Keep on developing the skills, get NISM certifications renewed, and comply with SEBI regulations to maintain progress.

Career Options in Stockbroking

A qualified stockbroker in India can choose to work in the following financial market positions:

- Equity Dealer / Trader: The person will place clients’ orders for equity and derivatives.

- Investment Advisor: Will provide clients with personalized portfolio and trading advice (SEBI Registered Investment Advisors).

- Research Analyst: Will analyze the market, write investment reports, and help traders make decisions.

- Relationship Manager: Hire and maintain client portfolios, making sure that clients are happy and not lost.

- Portfolio Manager: Work with the investments and create the strategies for trading of high-net-worth clients.

- Independent Sub-Broker or Franchise Owner: Get a deal with a large brokerage firm, such as Angel One or Motilal Oswal, to work with clients in an area.

Quick Reality Check (Stats and Facts)

- The registered investor base in India reached 10 crore in August 2024.

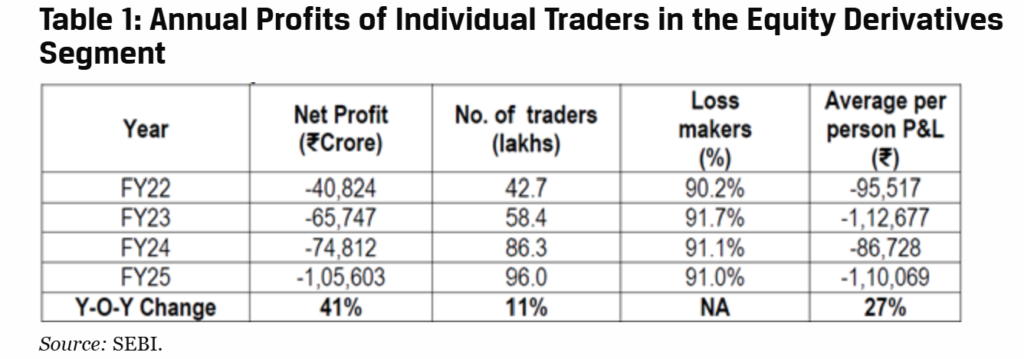

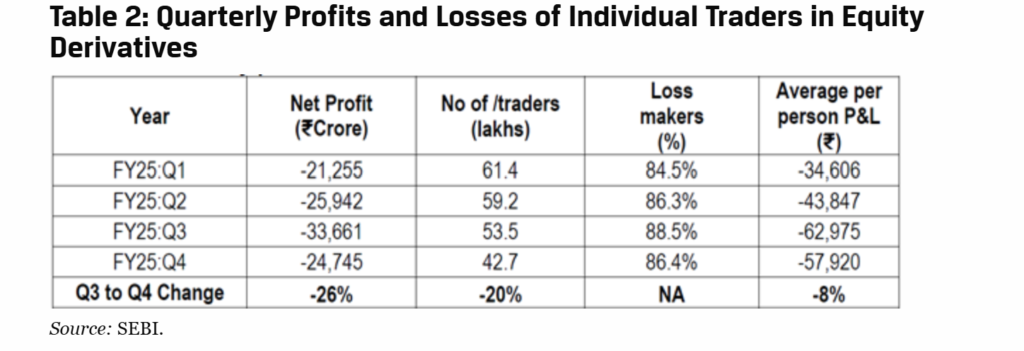

- Traders at the level of individuals selling and buying equity derivatives, during the fiscal year 2025, had to account for a ₹1.06 trillion loss, which was an amazing 41% hike over the previous year.

- The total number of demat accounts rose from 40 million in 2020 to 140 million in 2024, suggesting that more than 100 million new investors came to the market in this four-year time span.

Conclusion

In India, the process of becoming a stockbroker is structured. The individual should meet the educational requirements, pass the NISM certifications, get the necessary experience, and obtain membership with the stock exchanges, such as NSE or BSE. Brokers are required to further ensure they have proper infrastructure, good risk-management systems, and compliance with SEBI regulations. A career in stockbroking presents long-term prospects that are nurtured through continuous learning, regulatory discipline, and responsible client service.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.