Indian investors are increasingly investing in more than one mutual fund for the sake of diversification, and the number of SIP accounts in India reached over 40 million by 2025. It is not uncommon for a number of funds to have the same stocks, which results in portfolio overlap. This situation weakens the effect of diversification and consequently increases the risk factor.

Research indicates that the largest Indian equities mutual funds can have up to 40–70% of their portfolios in common, thus diminishing potential returns. Investors can access free tools such as 1Finance, Dezerv, Advisorkhoj, MutualFundsKaro, and PrimeInvestor to compare funds and check overlap data. For example, if two high-performing large-cap funds reveal 47% overlap, then these calculators are critical in minimizing redundancy and ensuring a properly diversified investment portfolio.

What is Mutual Fund Overlapping?

Mutual fund overlapping happens when multiple funds hold many of the same stocks, reducing diversification and increasing risk. Tools like 1 Finance, Advisorkhoj, Dezerv, PrimeInvestor, and MutualFundsKaro help identify overlaps, showing shared holdings and sector exposure to aid better portfolio allocation.

Top Free Mutual Fund Overlap Calculator Tools for Indian Investors

1. 1 Finance Mutual Fund Overlap Calculator

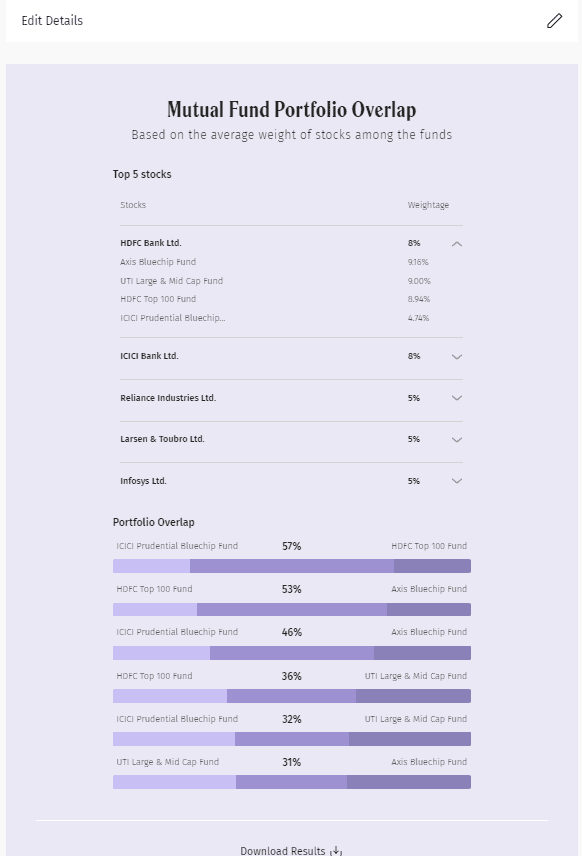

1 Finance has provided an AI-based tool for the overlap of mutual funds that allows investors to check the five mutual fund schemes at the same time. With India having over 4 crore SIP accounts and ₹25 lakh crore in mutual fund AUM (2025), such tools are crucial for avoiding duplication. For instance, overlap between large-cap funds can range from 35–60%, reducing true diversification. By using this tool, investors can spot duplication and thus their fund rebalancing decisions will be more informed.

Key Features:

- One-time comparison of five schemes.

- Providing the overlap percentage in an easy-to-read format along with data-driven insights to support better portfolio diversification.

- Very valuable for investors who have multiple SIPs in a similar equity category

- Showing the leading overlapping stocks together with their portfolio weight.

Snapshots

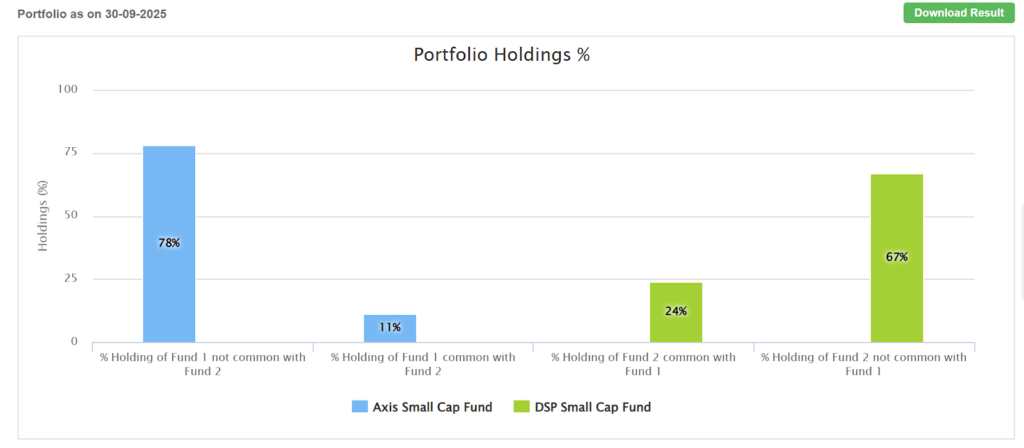

2. Advisorkhoj Mutual Fund Overlap Tool

Advisorkhoj Mutual Fund Overlap Tool offers a detailed and user-friendly mutual fund overlap calculator that enables investors to compare funds from different asset management companies (AMCs) and evaluate how much of their holdings are common or unique. The tool clearly presents percentage overlap data, allowing investors to gauge whether their portfolio is genuinely diversified or concentrated in the same stocks.

Key Features:

- The mutual fund coverage is vast, which includes large-cap, mid-cap, ELSS, as well as hybrid funds.

- Displays the number of holdings with overlaps and the ones that are unique.

- Makes it easy to understand the overlap reports for Indian schemes.

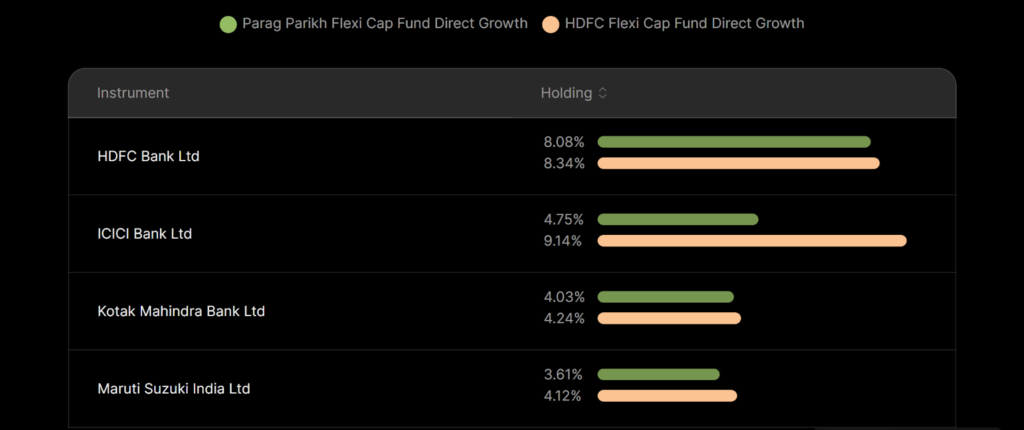

3. Dezerv Portfolio Overlap Calculator

Dezerv has created a modern and highly interactive mutual fund overlap calculator specifically for equity investors. The tool allows comparison between two mutual funds and visually presents the results using Venn diagrams and charts, making the overlap analysis simple and quick to interpret. It categorizes overlap into Low (0–20%), Moderate (20–60%), and High (60%+), helping investors instantly assess their risk exposure. According to Dezerv’s data, overlaps between large-cap funds in India typically range from 35% to 55%, showing that many portfolios are less diversified than they appear.

Key Features:

- Calculates overlapping in terms of percentages (Low, Moderate, High).

- Venn-diagram visualization for clearer comprehension.

- Shows duplication and fund similarity levels.

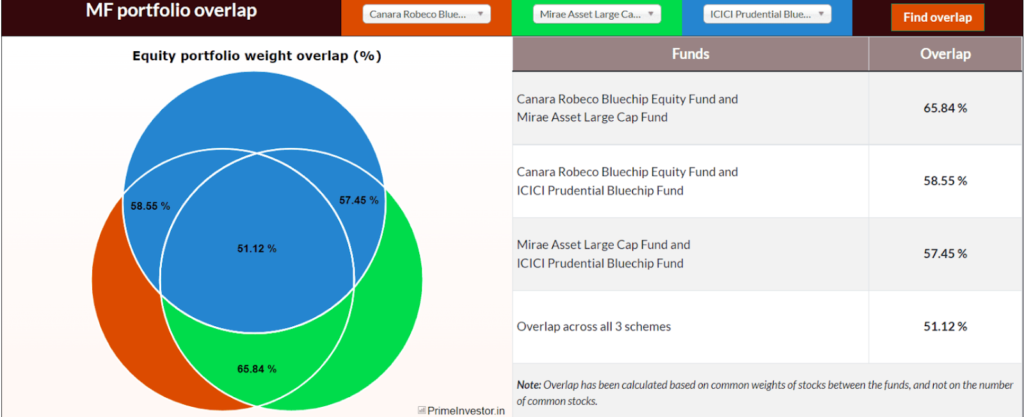

4. PrimeInvestor Overlap Tool

PrimeInvestor’s Overlap Calculator is a free tool that compares two or three mutual funds by analyzing portfolio weight overlap rather than just counting common stocks. It provides overlap percentages and professional guidance on when to rebalance or switch funds to avoid duplication. With India’s mutual fund AUM at over ₹25 lakh crore and more than 4.2 crore active SIPs, large- and multi-cap funds often have 60–65% overlap. The tool helps investors maintain better diversification, control risk, and optimize portfolio performance.

Key Features:

- A maximum of three funds can be evaluated collectively.

- Shows overlapping by portfolio weight rather than just by stock count.

- Advice on when fund switching due to overlap should be taken into account.

Snapshots?

5. MutualFundsKaro Overlap Tool

MutualFundsKaro offers a fast and user-friendly overlap calculator suitable for both beginners and experienced investors. It supports equity, hybrid, and debt funds, allowing cross-category comparisons. The tool displays overlap percentages, unique holdings, and key fund metrics in a clear interface. Overlap percentage, unique holdings, and other fund metrics are shown in a neat interface.

Key Features:

- Category filters that allow for fast fund selection

- Shows overlap percentage and unique holdings

- Allows for comparing funds across categories, the tool is quite suitable for that.

Add snapshots

Comparison Table

Investors in India can use the mutual fund overlap calculator tools free of charge, which are compared in the table below. The platforms differ in terms of the number of schemes to be compared, the categories of funds to be focused on, and the main benefits. The use of these tools makes it easy for investors to point out the overlaps in the portfolio, improve the diversification, and thus, make better investment decisions.

| Tool Name | Max Schemes Compared | Fund Type Focus | Key Advantage |

| 1 Finance | 5 | Equity & Hybrid | Shows top overlapping stocks with weights |

| Advisorkhoj | 2 | All categories | Simple, fast, and covers the Indian fund universe |

| Dezerv | 2 | Equity only | Visual overlap and categorised results |

| PrimeInvestor | 3 | Equity mutual funds | Expert insights and overlap by portfolio weight |

| MutualFundsKaro | 2 | Multi-category | Works for debt, equity, and hybrid fund comparisons |

Reference: Value Research Online

Conclusion

Mutual fund overlap calculators are essential tools that help investors maintain balanced and diversified portfolios. Overlapping portfolios especially in large-cap funds reduce diversification by exposing investors to the same stocks. The top free tools in India for 2025 include 1Finance, Advisorkhoj, Dezerv, PrimeInvestor, and MutualFundsKaro. These platforms offer visual comparisons, overlap percentages, and insights into common and unique holdings. By using these tools before investing or rebalancing, investors can identify duplication, strengthen diversification, and optimize portfolio performance for better long-term returns.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.