Have you taken a personal loan and aspire to end the repayment as quickly as possible? Look no further. Your guide personal loan prepayment calculator is here to guide you in each step.

Personal loans are one of the most flexible and accessible credit options in India. It is the amount a lender (Banks and NBFCs) gives to a borrower to fulfill the borrower’s urgent financial needs. In India, personal loans are usually unsecured; thus, no collateral or assets are required. Besides, they get approved quickly, and their repayment tenure ranges between twelve months (1 year) to eighty-four months (7 years), making them one of the most sought-after loan options. It is mainly taken to meet uncertainties like debt, medical expenses, home renovation, weddings, travel, funding education, business loans, etc.

However, every coin has two sides. Personal loans often come with higher fixed interest rates or floating interest rates. While the principal amount for a personal loan can range from ₹50,000- ₹50,00,000, the interest rates vary from 10%-24% per annum depending on the loan amount, the person’s income, and the credit score. Often, the interest outweighs the principal towards tenure end. To avoid this, one can try prepayment options either partially or fully. Here comes the savior, a Personal loan prepayment calculator to aid them in their repayment journey.

Manual EMI Calculation: Process and Procedure

Personal loans are a quick fix for anyone facing a financial crisis. Yet, in the future, it can become a bigger trap if EMIs are not taken into consideration before taking the loan. If one fails to deliver the EMIs on time, it reduces the credit score, gets compounded, and makes it difficult for the borrower to take further loans.

To calculate the EMIs on a personal loan, one needs to consider all three major components of the loan.

- Loan Amount/Principal: It is the amount of money borrowed by the individual from the financial lending institution.

- Rate of Interest: It is the amount of interest charged by the lender to the borrower on a yearly basis.

- Loan Tenure: It refers to the repayment period during which the borrower needs to repay the principal amount, in addition to the interest charges to the lender.

Formula For EMI

Let’s take Principal = P

Rate of Interest = R

Loan Tenure = N

The formula for EMI = [P x R x (1+R) ^N]/ [(1+R) ^N-1]

Here, R is divided into 12 to give a monthly calculator.

Example

Ramesh takes ₹8,00,000 as a personal loan for medical expenses with an interest rate of 12% per annum. If the loan tenure is 3 years, find the EMI.

R= 12%= 12/12 = 1/100= 0.01

P = 8,00,000

N= 3 years

EMI = [P x R x (1+R) ^N]/ [(1+R) ^N-1]= 8,00,000* 0.01* (1+0.01)^36/(1+ 0.01)^36 -1)

= (1.01)36≈1.43077

= 8,00,000×0.01×1.43077 / 1.43077-1 = ₹26,571.9

These calculations can be done for short amounts; however, for large calculations, online tools will be helpful, like a personal EMI calculator.

Reasons Manual Calculations Become Tough To Adopt

During high-interest loans with long tenures, it is practically impossible to use manual calculations and calculate EMI. Here are the reasons why.

The Complex Formula

The EMI calculation formula is too complicated.

EMI=(1+R)N−1P×R×(1+R)N

With an increase in time, there come significant changes in both the rate of interest, R, and the time frame, N. These components get added, subtracted, divided, and compounded, all while increasing the chances of mistakes in manual calculations.

Change In Loan Variables

With time, the principal amount changes, the monthly EMIs leave scattered interests, and the time period gets compounded. It becomes highly difficult to manage the increasing interests, keep track of changing principals, and do proper calculations.

Difficulty in Comparisons

If one wants to compare multiple loans, their performances, interest charged over the years for a longer duration, like five to seven years, it’s harder to calculate manually every month.

Lacks In Real-Time Updating

If an individual prepays part of the loan or if interest rates change over time, it becomes difficult to adjust it manually in the upcoming months. Thus, it becomes error-prone and incorrect data regarding what the remaining principal is, and how much EMIs one has to pay further.

An online personal loan prepayment calculator is extremely valuable here, functioning automatically and eliminating all the human-made errors.

What is a Personal Prepayment Loan Calculator

Personal Loan Prepayment

Personal loans are unsecured and can be availed in hours or days through digital approval. However, the interest rate is quite high, and paying equated monthly installments (EMIs) can often drain the investor’s funds.

If you are facing a similar situation and want to finish off your outstanding loan early, the prepayment option is available to you.

Personal loan prepayment refers to the early repayment of the loan amount, partially or fully, before the completion of the loan tenure. It helps in saving interest amounts over the long term.

Partial Personal Loan Prepayment

In this payment, the borrower pays an extra amount aside from their EMI or above, to reduce the outstanding capital. This helps the borrower to reduce the outstanding loan amount, lower EMIs, and decrease the loan tenure as well.

However, it attracts penalties ranging from 1%- 3% of the principal amount.

Example

If Ramesh has taken a personal loan of ₹8,00,000 to fund his sister’s education, and his EMI is ₹15,000 for a five-year tenure. In the third year, he collected some savings and got a bonus from his employer equal to ₹1,00,000. He decides to use this amount for pre-payment and lower the loan amount.

However, how is Ramesh going to know that after paying ₹1,00,000 as prepayment, how much outstanding loan capital will remain, and what will be the EMIs afterwards?

Here, a personal loan prepayment calculator comes in handy, taking all the data required and giving Ramesh the results he is looking for.

Personal Loan Prepayment Calculator

Personal loan prepayment calculator is an online tool that helps a borrower estimate how much money he or she is going to save, or what is the reduction in loan tenure. It will give the borrower a detailed restructured payment plan after the prepayment is made.

Required Inputs

A personal loan prepayment calculator requires the following inputs

- The outstanding loan amount by the borrower

- The interest rate charged by the financial organization

- The Current EMI being paid by the borrower every month

- The remaining loan tenure to pay the loan

- The Prepayment amount the borrower wishes to pay

Estimated Outputs

After taking all the details, the calculator will give the results in the following areas.

- It will show how much interest will be saved after the prepayment.

- It will showcase the new outstanding principal amount.

- It will tell the borrower the reduced EMIs he or she has to pay every month or the reduction in the time period in which the loan has to be repaid.

Real-Case Scenario

Suresh is a baker who took a ₹20,00,000 loan for his bakery at a 15% rate of interest for a tenure of five years as a personal loan. Before the completion of the second year, he felt his EMIs were high, and he could repay the loan earlier, as his bakery was doing good business, and he was able to save ₹2,00,000 that year in two installments.

Now he wants to use the amount as his pre-payment for the second year-end.

Before Pre-Payment

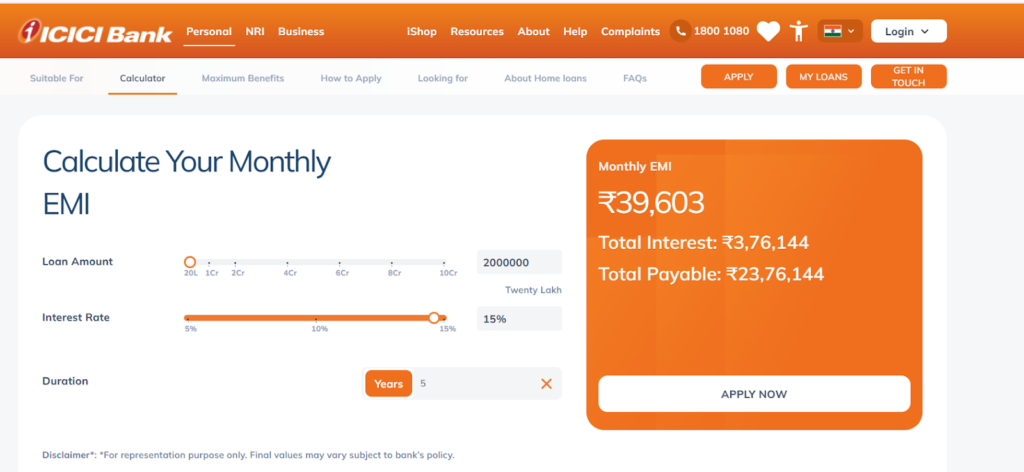

As we see, clearly, Suresh has to pay ₹39,603 as EMI every month for five years.

However, at the end of the second year, once he pays ₹2,00,000 as an additional payment, let’s see what changes it brings to his loan repayment schedule.

After Prepayment

By the end of the second year, paying EMIs on a ₹20,00,000 loan at a 15% annual interest rate, the outstanding principal, or capital, that Suresh will need to pay is

=2 * 12 * 39,603 = ₹9,50,472

= ₹14,25,672₹23,7

So now, Suresh has to pay ₹14,25,672 as the remaining capital, and he has decided to pay ₹2,00,000 as prepayment.

By using a personal loan prepayment calculator, Suresh can estimate his further repayment scenario.

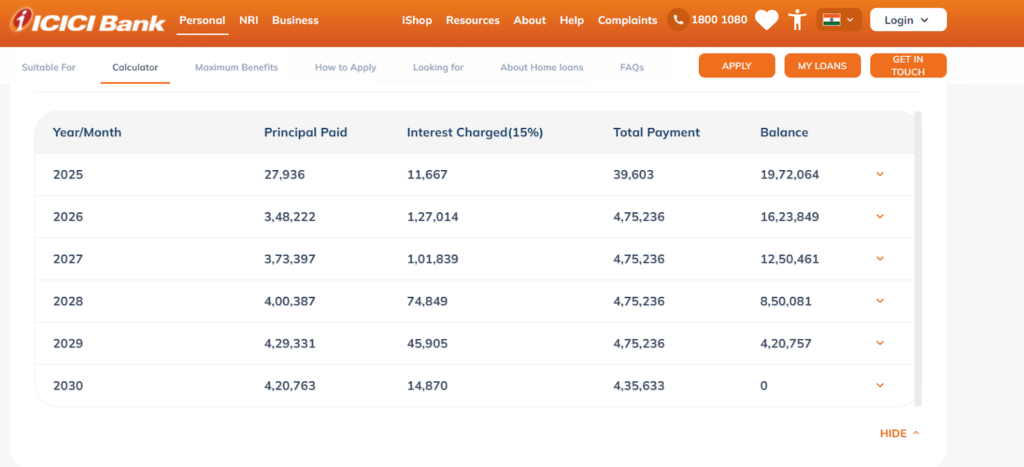

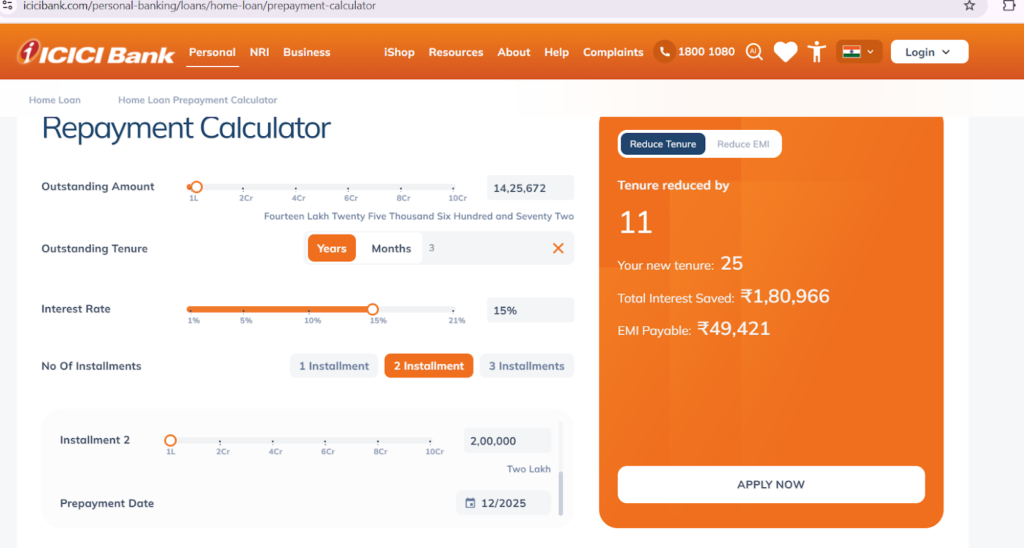

If Suresh desires to have a shorter loan tenure using his prepayment, he can take that option in the calculator.

For One Installment

As displayed, for one installment of ₹2,00,000, Suresh can reduce his tenure by six months. His EMIs, however, will rise to ₹ 49,421.

For Two Installments

As shown, for prepayment of ₹2,00,000, his tenure will be reduced by 11 months. Thus, it is more beneficial.

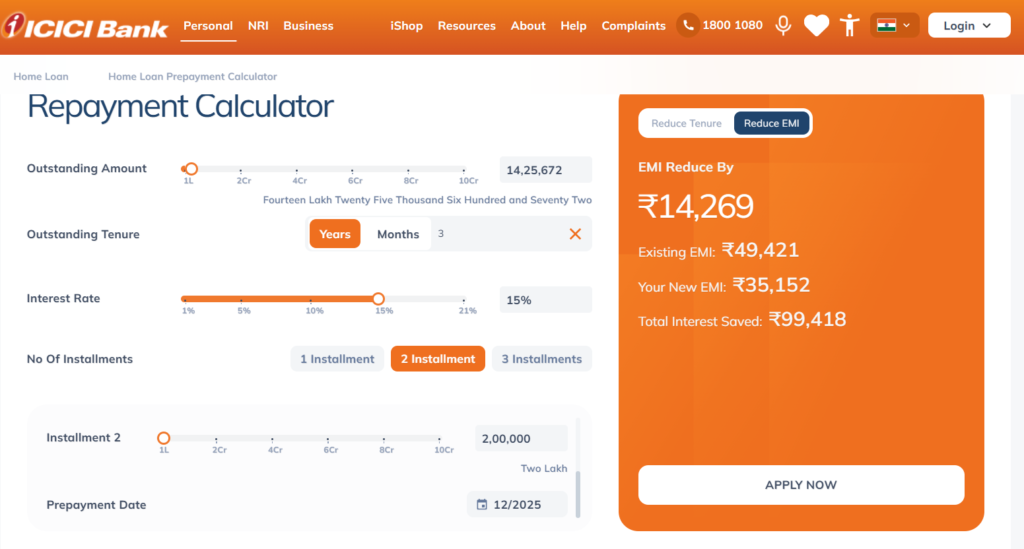

For Lower EMIs

If Suresh aims to lower his EMIs through this prepayment, he can achieve this too. The personal loan prepayment calculator can rightly estimate and show him how much he will be able to save here.

Here, Suresh can save ₹14,269 in EMIs. His EMIs declined to ₹35,152 monthly. Similarly, he saved ₹99,418 in total interest.

Thus, we saw with a personal loan prepayment calculator how Suresh would be able to estimate and decide his further repayment structure and duration as per his convenience.

Advantages of Utilising a Personal Loan Payment Calculator

Instant and Accurate Calculations

A personal loan payment calculator makes the complex calculation of EMIs, remaining tenure, instantly and at ease. It gives accurate predictions regarding the remaining repayment structure of the borrower and breaks down the data.

Effective Planning

Under the guidance of a personal loan prepayment calculator, you can plan your prepayment amount, how that amount will shorten your tenure, and how your EMIs will be reduced. Further, you can compare different prepayment amounts, the number of installments you want to make it, and estimate the remaining capital, EMIs, and tenure.

Financial Comparison

The personal loan prepayment calculator helps an individual in comparing numerous different prepayment amounts and their impact on the loan outstanding.

If Jack has a personal loan of ₹25,00,000 for seven years at 20% EMI. He has paid ₹8,00,000 in 1 year and 6 months. Now he wants to make a partial payment of ₹2,00,000 in two installments, or ₹4,00,000 in a single go; he can compare and see through the calculator. He will be better able to plan accordingly.

Hassle-Free

One of the major benefits of a personal loan prepayment calculator is that it saves significant time and effort for a borrower. The borrower does not have to do manual calculations using complex formulas, or keep Excel tabs counting his principal, interests, remaining EMIs, and update them every time.

It helps an individual to focus on more crucial tasks at hand like financial planning and ways to resolve the loan quickly.

Improved Financial Decision

Individuals armed with the personal loan prepayment calculator can make better financial decisions. As the calculator breaks down the principles, EMIs, and tenure from beginning to end, a borrower can easily decide after the lock-in period and considering penalties that how much partial prepayments they can make to close off the loan early or reduce EMIs.

Conclusions

Personal loan prepayments are an effective option to tackle the higher interest rates and EMIs, and to close off the loan earlier. Here, a personal loan prepayment calculator acts as a guide and mentor, helping the individual borrower plan his or her entire loan repayment roadmap. So, if you are someone who has just taken a personal loan or who is aiming to close the loan early, go ahead with the calculator. It’s totally free, gives almost accurate predictions, and finally saves your time and effort.

If you want to learn everything about stocks and make the right investments, check this out.

DISCLAIMER: The information given in this blog is for educational purposes only. Any content of this blog is not investment advice.